I have been working on a lot of new maps for the Economic & Wealth Maps page of this site. There are now over 50 maps, with more coming soon.

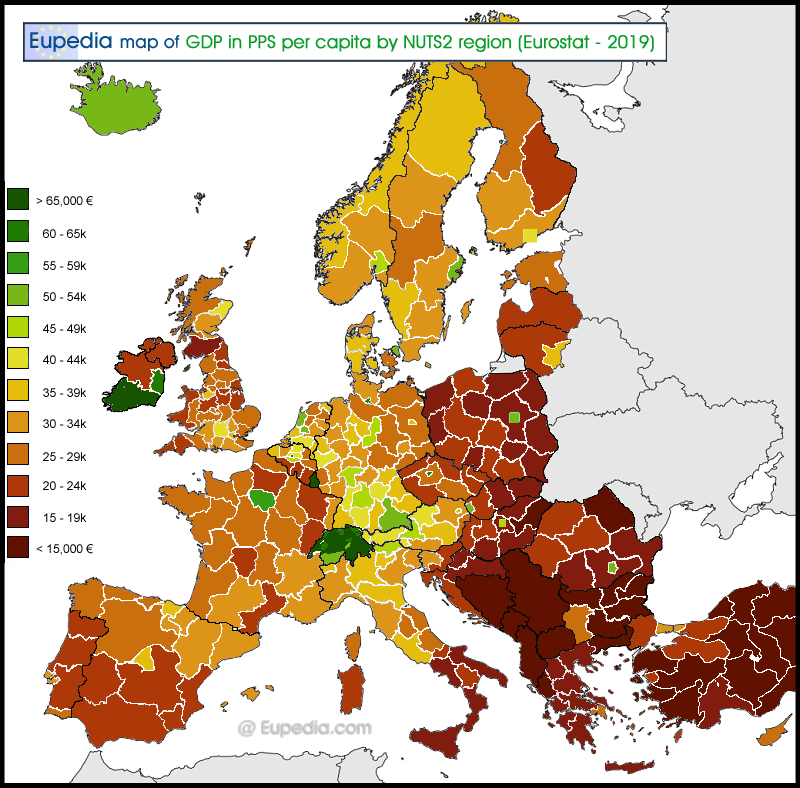

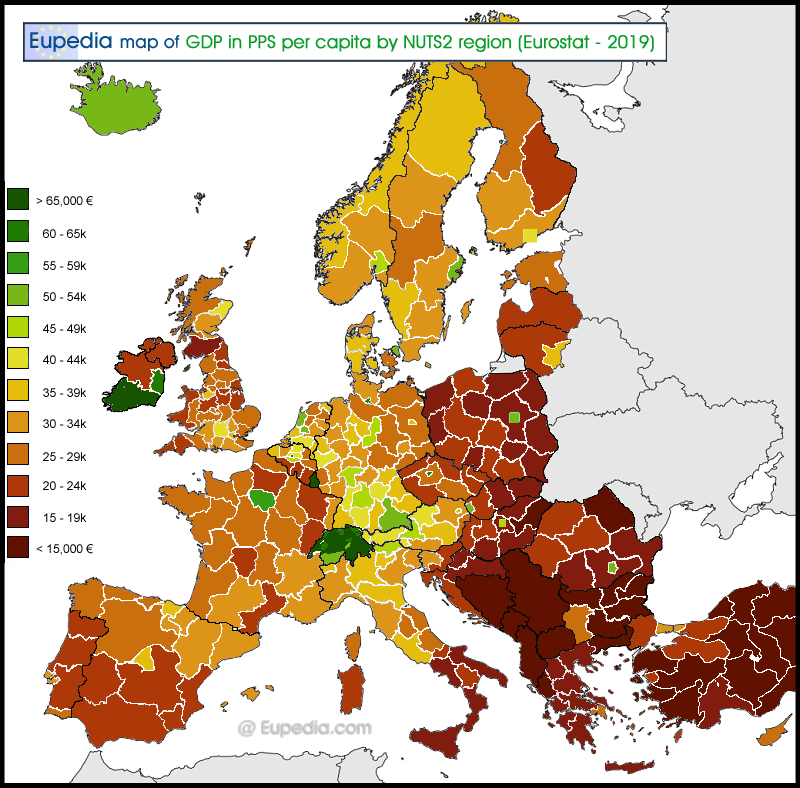

The one that took me the longest to make is the GDP per capita at Purchasing Power Standard (PPS) by NUTS2 region.

What is interesting here is how capitals of former Soviet bloc countries that are now in the EU have become beacons of economic development. Prague is now Europe's second richest city in terms of GDP per capita after Luxembourg and ahead of London or Paris! Bratislava, Warsaw, Bucharest and to a lower extent also Budapest all have higher GDP per capita than the German, French or British average, and are indeed wealthier than almost all West European and Nordic cities! They play in the same league as Stockholm, Copenhagen, Amsterdam, Paris, Frankfurt, Munich or Vienna.

The one that took me the longest to make is the GDP per capita at Purchasing Power Standard (PPS) by NUTS2 region.

What is interesting here is how capitals of former Soviet bloc countries that are now in the EU have become beacons of economic development. Prague is now Europe's second richest city in terms of GDP per capita after Luxembourg and ahead of London or Paris! Bratislava, Warsaw, Bucharest and to a lower extent also Budapest all have higher GDP per capita than the German, French or British average, and are indeed wealthier than almost all West European and Nordic cities! They play in the same league as Stockholm, Copenhagen, Amsterdam, Paris, Frankfurt, Munich or Vienna.