Over 10 years ago I wrote an article called What differentiates Europeans from Americans: the cultural gap across the Atlantic. I last updated it 5 years ago to add some more differences I had forgotten. One thing I did not mention, as it's not strictly speaking a difference between the US and Europe, is the use of credit scores. It turns out that European countries are divided on that matter. Some use it, but the majority don't. Here is a summary of where developed countries stand on credit scores.

In the US, one's credit score is a number between 300 and 850, which is determined by one’s debt level, number of open accounts, and repayment history. The higher the score, the higher the chances of getting credit from potential lenders. American banks also use credit scores to determine whether customers qualify for loans.

The British and Canadian systems are similar to the American one. The UK has three major credit agencies, Equifax, Experian, and Callcredit (Noddle). Each have their own scoring system, with a scale from 0 to 999 (Experian), 0 to 700 (Equifax), or 1 to 5 (Callcredit).

European countries typically have restrictive privacy laws, which makes it difficult or downright illegal to keep databases with customers' credit scores. Numerous data breaches over the years have not helped in this regard.

Countries that use credit scores extensively

Countries that use credit scores to some extent

These countries may use some sort of credit scoring system, but in combination to other factors like the borrower’s savings, income, experience in repaying debts, and/or length of employment.

Countries that do not use credit scores

These countries usually relies on the borrower’s credit history to determine a debtor’s creditworthiness.

It's worth noting that most European countries, and particularly those that do not use a credit scoring system, have populations that tend to be conservative in the way they spend money. Living on credit is usually frowned upon and discouraged.

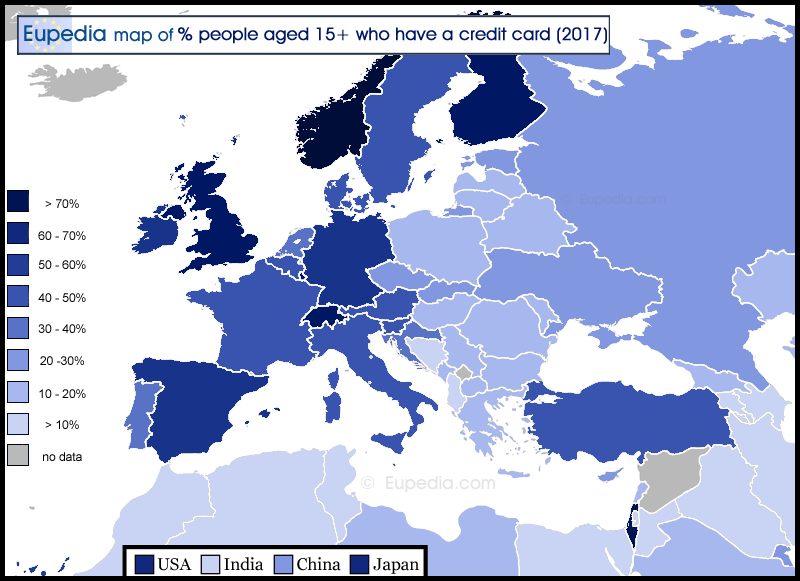

That doesn't mean that credit cards aren't common. On the contrary, in most of Western and Northern Europe card payments are at least as common as in the US. But purchases made with credit cards are by default set to be paid in their entirety at the end of the month.

I got my first credit card when I was 18, like a lot of people in Belgium, but I didn't know that in countries like the US it was possible to spread the payments on several months, or even indefinitely, and pay interests on those payments! Nowadays some banks offer this system in Belgium too, but very few people are willing to waste money on interest payments by not paying the bill in full at the end of the month.

I have travelled to almost all European countries (except most of the Balkans), but I have never heard the staff in a shop ask me if I wanted to spread the payment on my credit card over several months. In Japan, in contrast, shop staff typically do ask that (probably the American influence). As for spreading payment across multiple cards, I have only heard of it in American movies or series. I have never seen or heard of anyone do it in Europe or Japan. I am not even sure it's possible/acceptable anywhere in Belgium to divide a payment across multiple cards for a single purchase.

In the US, one's credit score is a number between 300 and 850, which is determined by one’s debt level, number of open accounts, and repayment history. The higher the score, the higher the chances of getting credit from potential lenders. American banks also use credit scores to determine whether customers qualify for loans.

The British and Canadian systems are similar to the American one. The UK has three major credit agencies, Equifax, Experian, and Callcredit (Noddle). Each have their own scoring system, with a scale from 0 to 999 (Experian), 0 to 700 (Equifax), or 1 to 5 (Callcredit).

European countries typically have restrictive privacy laws, which makes it difficult or downright illegal to keep databases with customers' credit scores. Numerous data breaches over the years have not helped in this regard.

Countries that use credit scores extensively

- Canada

- Germany

- Ireland : managed by the Irish Credit Bureau

- New Zealand

- Portugal : managed by the Bank of Portugal

- United Kingdom

- United States

Countries that use credit scores to some extent

These countries may use some sort of credit scoring system, but in combination to other factors like the borrower’s savings, income, experience in repaying debts, and/or length of employment.

- Australia

- Austria : uses a blacklist system

- Italy : Central Credit Register managed by the Bank of Italy, but used in combination with other data

- Norway : credit scores combined with publicly available information such as demographic data, tax returns, taxable income and any non-payment records

- Sweden: uses a blacklist system (also for failure to pay rent, utility bills, etc.)

- Switzerland

Countries that do not use credit scores

These countries usually relies on the borrower’s credit history to determine a debtor’s creditworthiness.

- Belgium

- Czechia

- Denmark : credit scoring companies only exist for businesses

- Finland

- France

- Japan

- Netherlands

- Slovakia

- Spain

It's worth noting that most European countries, and particularly those that do not use a credit scoring system, have populations that tend to be conservative in the way they spend money. Living on credit is usually frowned upon and discouraged.

That doesn't mean that credit cards aren't common. On the contrary, in most of Western and Northern Europe card payments are at least as common as in the US. But purchases made with credit cards are by default set to be paid in their entirety at the end of the month.

I got my first credit card when I was 18, like a lot of people in Belgium, but I didn't know that in countries like the US it was possible to spread the payments on several months, or even indefinitely, and pay interests on those payments! Nowadays some banks offer this system in Belgium too, but very few people are willing to waste money on interest payments by not paying the bill in full at the end of the month.

I have travelled to almost all European countries (except most of the Balkans), but I have never heard the staff in a shop ask me if I wanted to spread the payment on my credit card over several months. In Japan, in contrast, shop staff typically do ask that (probably the American influence). As for spreading payment across multiple cards, I have only heard of it in American movies or series. I have never seen or heard of anyone do it in Europe or Japan. I am not even sure it's possible/acceptable anywhere in Belgium to divide a payment across multiple cards for a single purchase.