What do you need to know before buying a house or an apartment in Europe, either as a residence or as an investment? The purchasing process and the taxes and fees pertaining to it vary a lot between countries. In countries like Belgium, France and Italy, it is compulsory to pass through a public notary, which increases the costs, but also provides extra security, as the notary is legally responsible to carry out all the due diligence protocols, such as verifying the origin of the property, whether the seller has a mortgage on it, if the property is conform to all legal urbanistic requirements, but also the soil pollution or the potential public works scheduled in the neighbourhood that could affect the buyer. The seller must provide an electrical certificate of compliance and an Energy Performance Certificate (EPC). In France sellers must even provide technical real-estate diagnoses for the presence of asbestos, lead and termites. In that regard France probably offers the most detailed information and best protection to the buyer.

How much taxes will I have to pay?

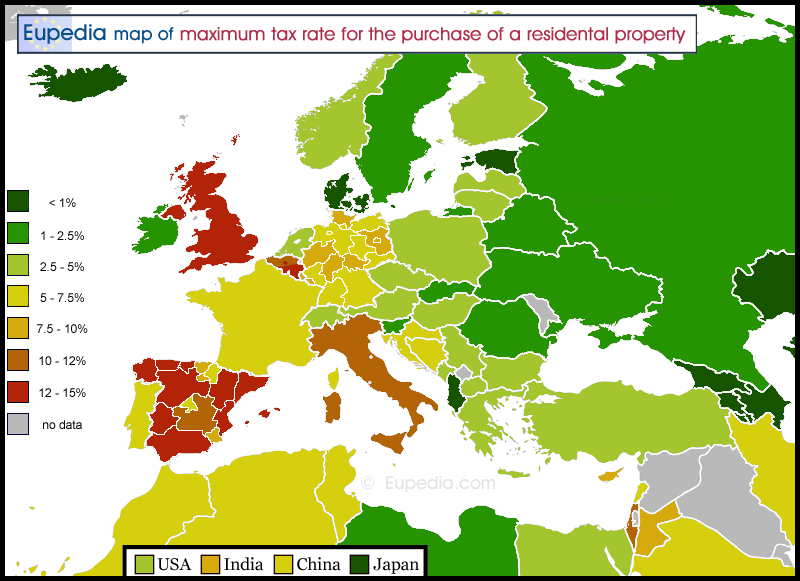

The tax rate for acquiring real estate varies hugely between countries. There are almost no taxes in Iceland, Denmark or Albania, but it can exceed 12% in Britain, Belgium, Italy and parts of Spain.

The following map helps you visualise the difference across the continent at a glance. The tax rate indicated comprises the total of all acquisition taxes and fees known, depending on the country, as stamp duty land tax (SDLT), notary fees, property registration fees, real estate tax (RET), real estate transfer tax (RETT), etc. The real estate agent's fee and the VAT on new properties are not included, as these do not apply to all purchases.

Differences between countries

Some countries (e.g. Cyprus, Israel, Portugal, UK) have variable tax rates depending on the price of the property. In such cases the highest rate was taken into account.

In the UK the so-called Stamp Duty Land Tax (SDLT) is progressive and can be as low as 0% for the purchase of a main residence if the price is inferior to £125,000, or as high as 12% for a home worth over £1.5 million. For the purchase of ‘additional’ property an extra 3% is applied to the standard rate, so that the maximum is effectively 15%. It's a good system in that poorer people pay less, while rich people with multiple very expensive properties pay the highest tax rate.

In Portugal the transfer tax is also progressive and ranges from 0% to 8%. There is also a stamp duty of 0.8%.

Belgium, France, Italy and Spain have various categories of taxes to pay when buying a property: the transfer tax, the property registration tax, and the public notary's fee (also a percentage of the property price), as well as fixed fees of a few hundred euros for administrative costs.

In Italy the property transfer tax is 12% for land, 9% for real estate assets (such as investments, commercial properties, and luxury homes), or 2% for the main residence of a private individual. However this is not calculated on the actual sale price, but on the cadastral value of the house. To this must be added the notary's fee (around 1% of the property price), the land registry tax (50€ or 200€), and the real estate tax (imposta municipale unica), which ranges from 0% to 1.14% depending on the municipality. So in the case of a property bought as the main residence of a private individual the tax rate is comprised between 3% and 4.14%, which is low by Western European standards, but it can rise to over 11% if it's an investment (e.g. buy-to-rent), a secondary residence (holiday home), a luxury home, or if it is purchased by a company.

France is relatively straightforward (for once, anything can happen). The property acquisition taxes and fees are always around 7%. There are minor differences between departments, but only within 0.2%.

Belgium has the highest tax rate in Europe (and probably in the world) for a main residence, at 12.5% (Brussels and Wallonia) or 10% (Flanders), regardless of the price of the house or apartment.

In Spain the rate for the transfer tax (only) depends on the autonomous region and can be progressive in some regions. The lowest are in Madrid and Navarre (6%) and the highest is in Catalonia and the Balearic Islands for properties over 1 million euro (11%). The registration tax, documented legal acts (0.5% to 1.5%) and lawyer's fee (1% to 4%) have to be added on top of that. Another particularity of Spain is that the notary's fee is divided between the buyer (30%) and the seller (70%).

In Germany the real estate transfer tax (RETT) also depends on the state and can be 3.5% (Bavaria, Saxony), 4.5% (Hamburg), 5% (Baden-Württemberg, Bremen, Lower Saxony, Mecklenburg-Western Pomerania, Rhineland-Palatinate, Saxony-Anhalt), 6% (Berlin, Hessen) or 6.5% (all other states). To that must be added the notary's fee and land register fees, which are a fixed 2% in all Germany.

In Ukraine, the maximum tax rate for primary property is 2%, but it can go up to 8.5% for secondary residences.

Note that a few European countries have different rates for corporate properties (e.g. Sweden).

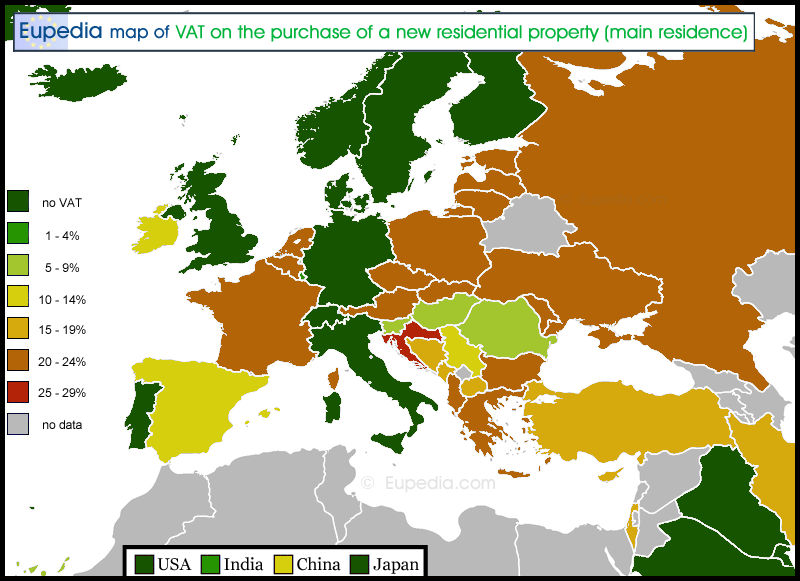

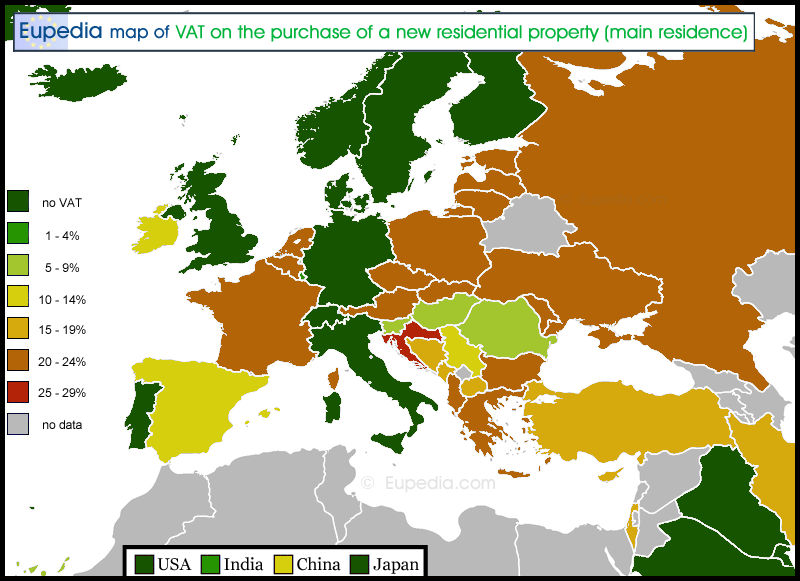

Countries with VAT on new constructions

When acquiring a new property, the buyer will have to pay VAT on the whole price of the house (normally instead of the other fees and taxes, not on top). VAT generally applies to constructions that are less than five years old in Western Europe and less than two years old in Central and Eastern Europe (except if otherwise specified), even if it's a second owner.

In Spain it is 'only' 10% (7% in the Canaries), but it is 13.5% in Ireland, 20% in Austria and France, 21% in Belgium, the Netherlands and Czechia (within 3 years of construction), 23% in Poland, 24% in Greece (first occupation only), and 25% in Croatia.

In Hungary the VAT rate on new properties (within 2 years) is normally 5%, but can be 27% for large houses (over 300m²), making it the highest in Europe.

Italy has a more complex system. VAT is only due if the purchase is made in the name of a registered company, even for residential properties. In that case it is 4% for main residences, 10% for secondary residences, and 20% for luxury homes. Purchasing in your own name, there is no VAT.

The UK and Germany do not charge VAT on property sales, except for commercial property transactions. In that case it si 20% in the UK and 19% in Germany.

Countries like Portugal, Switzerland, Iceland, Norway, Denmark, Sweden,Finland, and Russia have no VAT on property sales.

Real estate agent's fees

Countries with particularly high real estate agent fees include France (5%), Germany (from 3.5 to 8%) and Spain (3 to 10%). In contrast it is usually under 1.5% in the UK, Ireland, the Netherlands and Sweden, 2 to 3% in Switzerland, around 3% in Belgium, Italy, Canada and the USA, and 3 to 4% in Austria.

But who pays the estate agent's fee? In most countries it is the seller. However in some the costs are split evenly between buyer and seller (Germany, Greece, Italy, Japan). In France and the Netherlands it depends on the contract with the real estate agency, but it can be either the seller or buyer (but not both). In Spain it depends who seeks the services of the estate agent. If a buyer asks the agent to find a property for them, then they are the ones who pay the commission.

How much taxes will I have to pay?

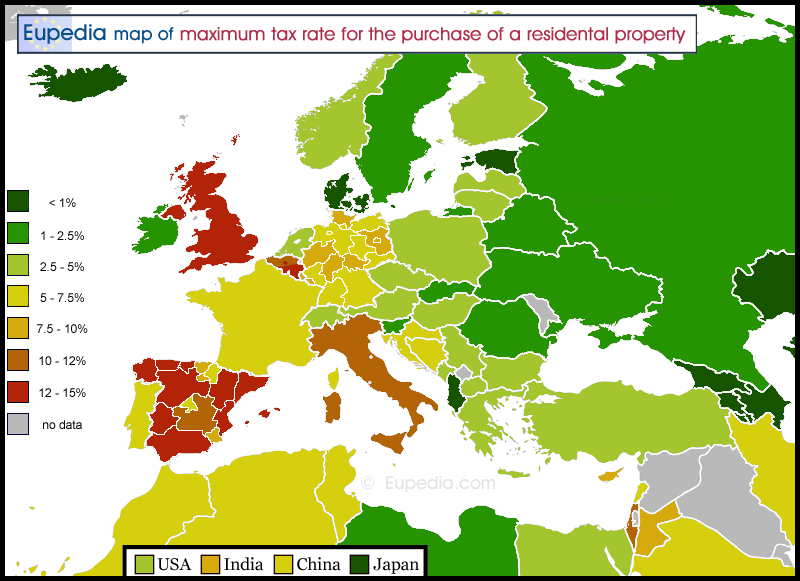

The tax rate for acquiring real estate varies hugely between countries. There are almost no taxes in Iceland, Denmark or Albania, but it can exceed 12% in Britain, Belgium, Italy and parts of Spain.

The following map helps you visualise the difference across the continent at a glance. The tax rate indicated comprises the total of all acquisition taxes and fees known, depending on the country, as stamp duty land tax (SDLT), notary fees, property registration fees, real estate tax (RET), real estate transfer tax (RETT), etc. The real estate agent's fee and the VAT on new properties are not included, as these do not apply to all purchases.

Differences between countries

Some countries (e.g. Cyprus, Israel, Portugal, UK) have variable tax rates depending on the price of the property. In such cases the highest rate was taken into account.

In the UK the so-called Stamp Duty Land Tax (SDLT) is progressive and can be as low as 0% for the purchase of a main residence if the price is inferior to £125,000, or as high as 12% for a home worth over £1.5 million. For the purchase of ‘additional’ property an extra 3% is applied to the standard rate, so that the maximum is effectively 15%. It's a good system in that poorer people pay less, while rich people with multiple very expensive properties pay the highest tax rate.

In Portugal the transfer tax is also progressive and ranges from 0% to 8%. There is also a stamp duty of 0.8%.

Belgium, France, Italy and Spain have various categories of taxes to pay when buying a property: the transfer tax, the property registration tax, and the public notary's fee (also a percentage of the property price), as well as fixed fees of a few hundred euros for administrative costs.

In Italy the property transfer tax is 12% for land, 9% for real estate assets (such as investments, commercial properties, and luxury homes), or 2% for the main residence of a private individual. However this is not calculated on the actual sale price, but on the cadastral value of the house. To this must be added the notary's fee (around 1% of the property price), the land registry tax (50€ or 200€), and the real estate tax (imposta municipale unica), which ranges from 0% to 1.14% depending on the municipality. So in the case of a property bought as the main residence of a private individual the tax rate is comprised between 3% and 4.14%, which is low by Western European standards, but it can rise to over 11% if it's an investment (e.g. buy-to-rent), a secondary residence (holiday home), a luxury home, or if it is purchased by a company.

France is relatively straightforward (for once, anything can happen). The property acquisition taxes and fees are always around 7%. There are minor differences between departments, but only within 0.2%.

Belgium has the highest tax rate in Europe (and probably in the world) for a main residence, at 12.5% (Brussels and Wallonia) or 10% (Flanders), regardless of the price of the house or apartment.

In Spain the rate for the transfer tax (only) depends on the autonomous region and can be progressive in some regions. The lowest are in Madrid and Navarre (6%) and the highest is in Catalonia and the Balearic Islands for properties over 1 million euro (11%). The registration tax, documented legal acts (0.5% to 1.5%) and lawyer's fee (1% to 4%) have to be added on top of that. Another particularity of Spain is that the notary's fee is divided between the buyer (30%) and the seller (70%).

In Germany the real estate transfer tax (RETT) also depends on the state and can be 3.5% (Bavaria, Saxony), 4.5% (Hamburg), 5% (Baden-Württemberg, Bremen, Lower Saxony, Mecklenburg-Western Pomerania, Rhineland-Palatinate, Saxony-Anhalt), 6% (Berlin, Hessen) or 6.5% (all other states). To that must be added the notary's fee and land register fees, which are a fixed 2% in all Germany.

In Ukraine, the maximum tax rate for primary property is 2%, but it can go up to 8.5% for secondary residences.

Note that a few European countries have different rates for corporate properties (e.g. Sweden).

Countries with VAT on new constructions

When acquiring a new property, the buyer will have to pay VAT on the whole price of the house (normally instead of the other fees and taxes, not on top). VAT generally applies to constructions that are less than five years old in Western Europe and less than two years old in Central and Eastern Europe (except if otherwise specified), even if it's a second owner.

In Spain it is 'only' 10% (7% in the Canaries), but it is 13.5% in Ireland, 20% in Austria and France, 21% in Belgium, the Netherlands and Czechia (within 3 years of construction), 23% in Poland, 24% in Greece (first occupation only), and 25% in Croatia.

In Hungary the VAT rate on new properties (within 2 years) is normally 5%, but can be 27% for large houses (over 300m²), making it the highest in Europe.

Italy has a more complex system. VAT is only due if the purchase is made in the name of a registered company, even for residential properties. In that case it is 4% for main residences, 10% for secondary residences, and 20% for luxury homes. Purchasing in your own name, there is no VAT.

The UK and Germany do not charge VAT on property sales, except for commercial property transactions. In that case it si 20% in the UK and 19% in Germany.

Countries like Portugal, Switzerland, Iceland, Norway, Denmark, Sweden,Finland, and Russia have no VAT on property sales.

Real estate agent's fees

Countries with particularly high real estate agent fees include France (5%), Germany (from 3.5 to 8%) and Spain (3 to 10%). In contrast it is usually under 1.5% in the UK, Ireland, the Netherlands and Sweden, 2 to 3% in Switzerland, around 3% in Belgium, Italy, Canada and the USA, and 3 to 4% in Austria.

But who pays the estate agent's fee? In most countries it is the seller. However in some the costs are split evenly between buyer and seller (Germany, Greece, Italy, Japan). In France and the Netherlands it depends on the contract with the real estate agency, but it can be either the seller or buyer (but not both). In Spain it depends who seeks the services of the estate agent. If a buyer asks the agent to find a property for them, then they are the ones who pay the commission.

Last edited: